Loans are helpful in establishing credit and accessing things you need that you can’t afford to pay outright. But without implementing a mindful repayment strategy, your debt could become unmanageable.

If you’re ready to minimize or even eradicate your debt, then look no further than this simple guide.

You can pay off your loans with patience, dedication and these proven methods.

Budget Accordingly

Adjusting to a lean budget will help you stay comfortable as you pay off your debt.

To create an effective budget, follow these four simple steps:

-

- Review your monthly expenses. Are you spending too much eating out? Do you have an impulse shopping habit? Be critical of your spending and brainstorm ways to minimize your expenses.

- Set aside funds for expenses. Tally up your monthly bills, account for the total in your budget and ensure all your bills get paid in full.

- Set limits. Set limits on flexible things and luxuries, like entertainment, travel, or dining out. Strategize how to stay under this limit throughout the month.

- Strategize your debt repayments. Now that you’ve trimmed your budget, allocate the leftover funds towards your debt.

The Snowball Method

This method lets you pay down your debts through cumulative, snowballing payments. It’s been popularized as Dave Ramsey’s second step in his 7 Baby Steps towards wealth.

The first step in the snowball method is to prioritize your debts. Prioritize either your smallest debt or your debt with the highest interest.

Pay the maximum amount possible towards your most outstanding debt. Once that is paid off, continue paying that much each month towards the next debt on your list.

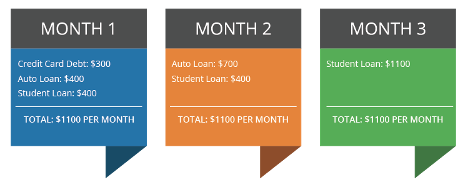

A long-term snowball payoff plan might look like this:

Many have found success with this method because it allows you to adjust to a long-term budget easily. It also helps you prioritize your debts by urgency and incentivizes you with milestones.

Earn More

Perhaps the most obvious strategy is to earn more money and contribute your additional income towards paying off your debt.

Aiming for a raise at work or taking on a second job are two great strategies for earning more. Though it may be tiring in the short term, getting a part-time job can greatly help you in your effort to pay down your debts. A second stream of income is a surefire way to earn more and owe less.

How to Pay Off a Car Loan Early

Interest payments are the hidden fees associated with buying a car that can completely ruin a person’s financial situation. If you’re paying back a car loan, you’ll want to allocate as much capital as possible towards that loan to reduce the interest accrued over time.

Calculate how much you need to pay above your minimum repayment plan in order to offset your interest. This number gives you a more accurate repayment plan. Commit to paying this amount each month so you can quickly meet your goal and minimize interest. You can use this debt repayment calculator to determine how much you need to pay.

Some lienholders offer automatic payments. If possible, adjust your automatic payment to a reflect the accurate repayment amount or make an extra payments on top of your automated payment.

How To Pay Off Student Loans

Paying off student loans is one of the most satisfying financial milestones.

As you would with an auto loan, calculate how much you need to pay in order to offset your interest and consider that amount your minimum payment amount.

While most companies will automate this process, you may have to call your student loan servicer and specifically request that they put overpayments towards your current balance or they’ll put it towards your next month’s payments.

With student loans, pay down your debt with the most interest first, and then move on to paying back your low-interest debts last.

Stay Out of Debt

To succeed in paying off your debts and stay debt-free, you have to permanently change the behaviors that got you into debt in the first place. You may have to overhaul your mindset and relationship with money.

If you struggle with making unnecessary impulse purchases, focus on learning to delay your gratification. Many struggle with living above their means in order to fit in with their peers. Making lifestyle changes will be in your best interest in the long run, even if they are uncomfortable at first.

If you’re beginning your journey towards being debt-free or simply seeking to pay off a few high interest loans, this guide will be of great use to you. Bookmark this page for guidance along your debt-free journey.